ASA distributors again report mixed sales results in January

Respondents to the American Supply Association’s monthly Pulse sales report survey reported sales declines of 2.1% for January 2021 compared to January 2020.

The full, detailed Pulse sales benchmarking report is an exclusive benefit for ASA members only and can be accessed through the MyASA portal at www.asa.net.

In this report, based on the number of respondents reporting results by state or area of operation, ASA is able to provide detailed results for 14 different market areas. Many additional areas are very close to having sufficient sample size to report results.

On a trailing 12-month basis, respondents reported average sales growth of 0.9% and a median of 1.9%.

Half of the Pulse respondents reported trailing 12-month changes between -3.8% to +6.3% as of Jan. 31, compared to the same timeframe in 2020.

Inventories rose 5.8% for January 2021 compared to January 2020, while the median three-months days sales outstanding rose from 39 days in the fourth quarter of 2020 to 42.2 days in January 2021.

A total of 43% of respondents reported decreasing gross margin percentages for January 2021 vs. January 2020.

“The sales decline will most likely be temporary as some of our members are reporting a steady demand in the market, and local economies showing resilience,” ASA Business Intelligence Analyst

Ayesha Salman said. “Even during a pandemic when most industries suffered, our members rode the wave. Remember, the decline is based on change from the previous year. According to ASA Chief Economist Dr. Chris Kuehl, the economic experts are projecting a V-shaped recover as most of the economic indicators are showing a positive trend.”

Industrial PVF

ASA members doing business in the industrial PVF space reported a 10.9% sales decline in January 2021 compared to the same period a year ago. Trailing 12-month sales for ASA industrial PVF distributors decreased 6.8%. Inventories rose 2.3% during this reporting period for industrial PVF distributors, while the average days sales outstanding for that sector stood at 45.

Fifty percent of ASA industrial PVF distributors responding to the survey reported the total number of full-time-equivalent employees dipped compared to the same period a year ago, while 31.3% of industrial PVF distributors reported a lowering of gross margin percentage as of Jan. 31, 2021 compared to the same reporting period a year ago.

Analysis of the past two years

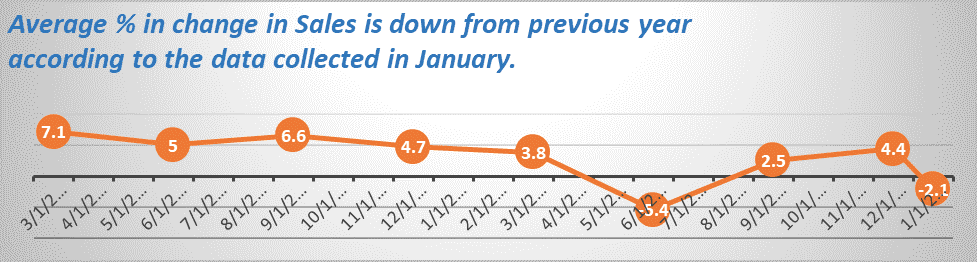

2019 turned out to be a booming year for our industry. It started off strong with a 7.1% increase in Q1 2019 from the previous year, trended a little downward but still up from the previous year overall. 2020 was a turbulent year, owing to the COVID-19 pandemic, which is evident from the deep plunge in June-July 2020, but it ended off stronger.

Respondents reported a median of 1.4% growth for the full year 2020 vs. 2019. Half of the respondents reported changes between -3.1% to +6.0% for year-to-date sales as of Dec. 31, 2020 vs. 2019. Inventory rose 4.9% for Q4 2020 vs. Q4 2019. The median three-months average days sales outstanding dropped to 39 days in Q4 2020. This was encouraging to see, as earlier in the year there were concerns that receivables were starting to increase.

Economic indicators

Fourth quarter GDP came in at about what it was expected to, and they were far from the drastic rebound numbers in Q3 when growth topped 33%. This was a reading far closer to normal at 4%. The expectation is that 2021 will be in a range between 3.5% and 4.5%. That depends on factors such as the lifting of lockdowns and the pace of the vaccine distribution. According to the economic experts, we can expect to make a full economic recovery by mid- to late summer. The forecast is of a V-shaped recovery.

Stimulus

The Biden administration is committed to the stimulus plan of close to $2 trillion, but critics assert that it is coming at the wrong time and may fuel inflation threats by summer. The plans now include a lot of infrastructure spending and an emphasis on green, but plans for a tax hike to pay for all this remain murky.

Important update

In response to some of our most engaged participants, ASA has switched to a monthly frequency for the Pulse sales report. The report has been improved by including more data while still maintaining member confidentiality.