Decarbonization and access to troubleshooting among peak demands of contractors, specifiers and end users.

By Natalie Forster

According to market research from IMARC Group, the global residential boiler market Reached $7.73 billion in 2021, and it is anticipated to reach $10.52 billion by 2027, at a CAGR of 5.10% over 2022-2027.

Additionally, Global Market Insights reports that the commercial boiler market size was estimated at over USD 8.5 billion in 2020 and is set to register more than 4% CAGR between 2021 and 2028.

To gain a boots-on-the-ground perspective of the growing boiler market, Supply House Times checked in with a few manufacturers.

Burner video courtesy of jessikla / Creatas Video / Getty Images. Steam video courtesy of Saracin / Creatas Video+ / Getty Images. Bathtub image courtesy of DaniloAndjus / Getty Images.

Peak demand

According to the experts, there is opportunity and demand in many segments of the boiler market with multi-family and single-family projects driving both the new construction and remodel segments.

“These top market segments are followed closely by education, hospitality and restaurant-related projects,” says John Kopf, product manager — boilers at Navien. “We can safely conclude that this trend will continue in the future.”

The general consensus is that post-pandemic projects are moving, but global supply chain issues continue to be a hurdle for boiler manufacturers. Lyndal Moore, commercial national sales manager at Raypak calls the boiler market “vibrant,” despite some ongoing issues.

“The boiler market is vibrant although challenging in the sense that in the post-pandemic era projects are moving again, but global supply chain and logistic issues are plaguing the overall boiler channel,” Moore explains. “Nobody knows for sure how the commercial space is going to react in the second half of the year as raw material cost continues to demonstrate upward volatility and interest rates climb. Either the market gets used to operating in this volatile environment and continues on, or it could end up cooling off. Which path it follows, or the exact timing is something that cannot yet be pinned down.”

Weil-McLain’s ECO Tec boiler features a 95% AFUE rating, making it among the highest energy-efficient residential boilers in the industry. ECO Tec achieved the “Most Efficient” rating level from ENERGY STAR in 2020 and is rated to deliver maximum operational cost savings to homeowners and provide qualification for local utility rebates, if available.

Image courtesy of Weil-McLain.

Moore adds that every sector of the market is experiencing high demand — multifamily, hospitals, education, prisons, etc. are all playing catch-up in the post-pandemic world.

A focus on high-efficiency and boiler system control technology are leading to an energetic market as well.

“The boiler market will continue down the path of non-condensing boiler system replacements with tougher minimum efficiency requirements on the horizon with advanced condensing boiler designs achieving greater system efficiency and footprint optimization for new build and boiler system upgrade projects,” says David DeVries, director of product management at Weil-McLain. “Boiler system control technology, building automation system integration and monitoring will continue to be targets for market differentiation. Alternates to fossil-fuel heating technologies will also become more commonplace.”

DeVries adds that the non-condensing cast iron boiler market continues strong in the Midwest and Northeast regions, tied to strong existing boiler population replacement and repair volume.

Economic outlook

While distributors, manufacturers and installers enjoy the high-demand landscape throughout the boiler market, there are a number of economic factors to keep an eye on.

Navien’s Kopf brings up the price increases boiler manufacturers have had to implement. “Inflationary pressures caused by increased costs of raw materials, supply chain issues and the rising cost of fuels forced most boiler manufacturers to adjust their pricing up by at least 5% or 6% year-over-year,” he says.

Although it’s expected to see inflationary issues eventually slow down, the constant labor shortages will continue to put financial pressures on the supply chain.

“Past issues with lack of highly trained service technicians were made worse by nation-wide labor shortages caused by the pandemic and resulted in a push for higher wages,” Kopf points out. “While inflation will eventually slow down due to both, governmental efforts and market self-correcting forces, the lack of skilled labor will continue affecting all trades in the short- and long-term.”

Bud Katzmann, marketing director for Triangle Tube agrees, saying labor is a main concern, and government regulations may present some challenges for the boiler market moving forward. “The demographics of installers present challenges when it comes to project efficiency and costs; we need the next generation of installers to enter the trades,” he says. “The disrupted supply chain for raw materials, pandemic and Government regulations and changes are also economic factors to be aware of.”

Emerging trends

Technology meeting efficiency is the name of the game in today’s boiler market.

“We have seen the continued shift to high-efficiency products for applications that can match and take advantage of the technology – and boiler thermal efficiency is a key design deliverable for new product design,” DeVries says. “Boiler system efficiency coupled with the other boiler system components that require energy (circulators, etc.) all make up the energy footprint that home-owners, building owners and facility managers alike want to minimize to reduce operating costs and to achieve environmental targets.”

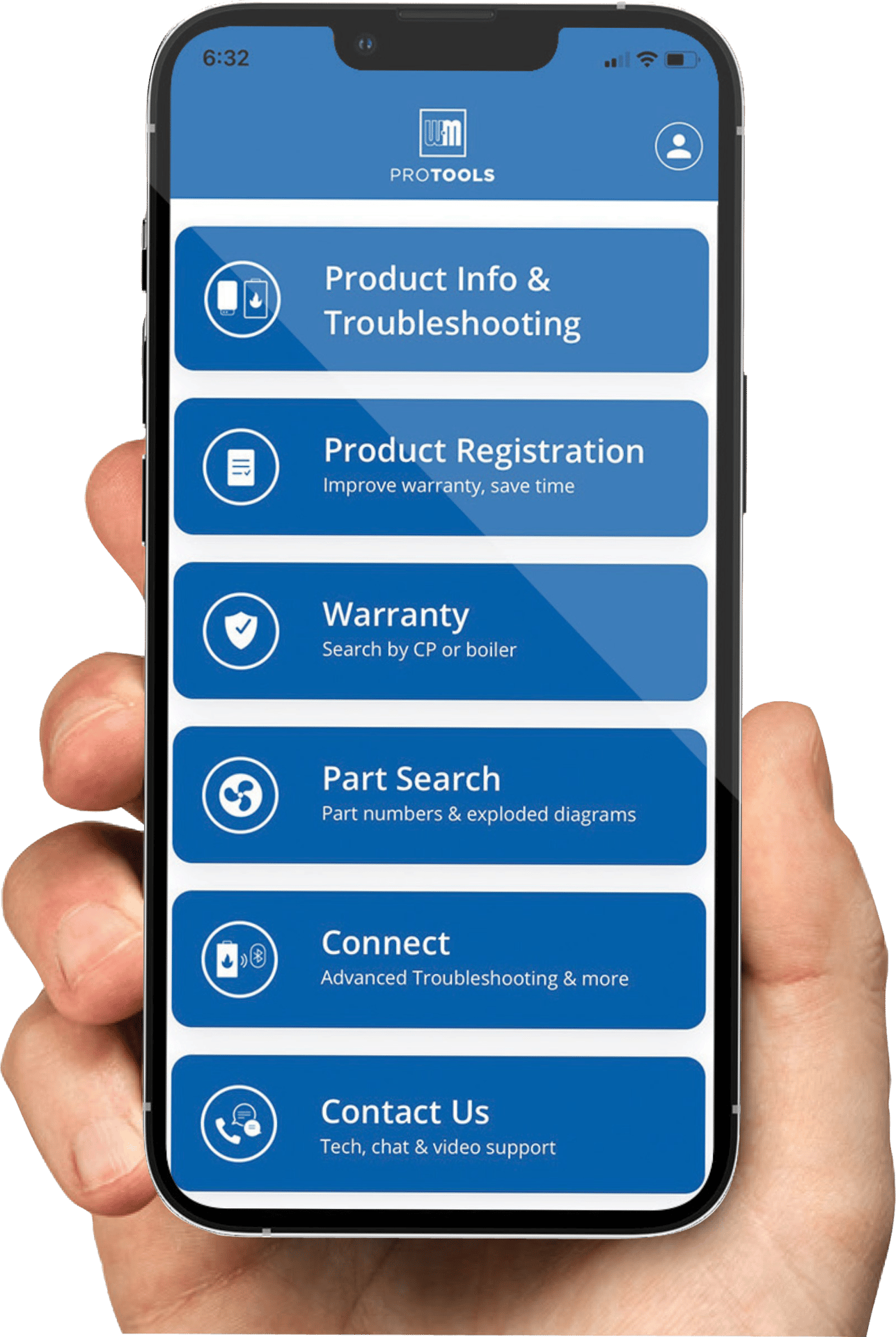

Weil-McLain’s PROTOOLS Tech app offers technical information, product videos, troubleshooting, parts searching, contact for tech support and more right from the smart phone.

Weil-McLain’s PROTOOLS Tech app offers technical information, product videos, troubleshooting, parts searching, contact for tech support and more right from the smart phone.

Image courtesy of Weil-McLain.

Protecting the environment continues to be top-of-mind for many homeowners, building designers and government agencies alike, and boiler manufacturers are rising to the challenge.

“Regulations focused on limiting carbon emissions will further drive efficiency in the boiler market resulting in a continuous decline in non-condensing boilers in favor of condensing models,” Kopf says. “Since Navien condensing boilers offer 95% efficiencies and higher, we feel that we are well-positioned to address any future regulatory increases in efficiency levels.”

Katzmann too points to efficient heating sources as prominent trends driving changes in the boiler market. “There is government interest in sources other than gas to heat buildings and incentives provided to consumers who choose high-efficient products,” he says. “Gas adaptive boilers that accommodate changes in gas type and quality and remote internet-enabled boilers that allow installers/technicians and manufacturers to access and support/diagnose boilers remotely are two other technology trends we’re seeing.”

Efficiency means more than just protecting the environment, as boiler manufacturers are focused on keeping installation time and troubleshooting time more time and cost-efficient than ever before.

“Continuing focus on maintaining low production costs, introducing products featuring a small footprint, expanding product line portfolios, and in-house development of key boiler components are becoming more and more important,” Kopf notes.

Customer needs

It’s no secret contractors need products that are easy to install, easy to learn about and easy to fix.

“Contractors need products that work and keep them on schedule to get them on and off jobs in a timely manner. For this reason, Raypak is adapting our go-to-market strategy by opening up five regional warehouses to better service and insulate our customers from delivery and scheduling issues,” Moore points out.