SEPTEMBER 2025

feature

Six key questions to ask yourself when succession planning

Steps to understand the market should you choose to sell.

By Brad Williams

champpixs / iStock / Getty Images Plus

Many business owners are blinded by the illusion that “If my business is successful now, it always will be.” When business owners allow this illusion to cloud their judgment, they are only hurting themselves in the long run. Although your business may be thriving presently, have you considered the future? What about retirement age? Potential competition outperforming you? Technological advancements surpassing your capabilities? This is why it is important to start succession planning now.

1.What are my company goals?

The first step for a successful succession planning process is considering your company’s goals and the people you need to achieve those goals. Creating a comprehensive 1-5 year business plan that addresses your organization's goals will be beneficial when trying to determine your next steps as a business. For example, if your goal is to grow your business by adding a new location, you need to create a step-by-step plan that addresses how you will achieve this goal. It is pointless to set goals without a course of action in place.

2. What is my exit strategy? Do I have successors? Interested buyers?

There are several ways to exit your business. One way is by being acquired by or merging with another company. Being acquired or merging with another business can be a profitable exit strategy for businesses and entrepreneurs. The Beringer Group has helped hundreds of clients find suitable buyers with our free business valuation.

Another way to exit is by passing on the business to a family member. Although this sounds straightforward, it can get quite complicated. This exit strategy, however, is a great way to put your next generation in a prominent starting position, as well as possibly providing many tax breaks for your company through the estate planning process that has to take place for the company to be passed along.

3. Do any potential successors align with the company's values and vision? Strengths? Weaknesses?

Although passing the business to your next in line might seem like an easy option, it might be worth it to research your potential successors. Evaluating potential candidates is a great way to see if they uphold your company’s values. In addition, you can assess their strengths and weaknesses to decide if they would make a good fit. Maybe there is someone on your management team that has potential, and you can look into training them early. The earlier you start preparing them for the role the smoother and easier the transition will be.

You might find that hiring someone externally is a better option. A lot of business owners dismiss outside hires because they assume they do not know enough about the business to offer useful advice. External hires look at the business through a fresh set of eyes. They contribute a different perspective that you and other team members might have never considered. All in all, no matter who you decide to hire, make sure to thoroughly assess all options. You do not want your company to get off on the wrong foot because you didn't research all your potential successors.

4. What skills and knowledge are required to keep the company running smoothly? How can I ensure a smooth transition of leadership?

If you or another essential employee decides to leave the company, is there a certain skill set or industry knowledge you would be taking with you? If you do not plan ahead, you will be leaving your successors in the dark. This is why it is necessary to assess where your company’s knowledge lives. Having a centralized location to store company information would be extremely beneficial when it comes time to part ways with the business. This way the right people have easy access to up-to-date information.

For instance, let’s say Dan is the CFO of a successful HVAC company, but it comes time for Dan to retire. Once the CFO position is filled, the new recruit cannot find any data on the company prior to their arrival so they have nothing to base their decisions on. If Dan had stored the company information in one centralized location, the new CFO would not have to waste time asking for help, allowing them to spend more time making educated decisions.

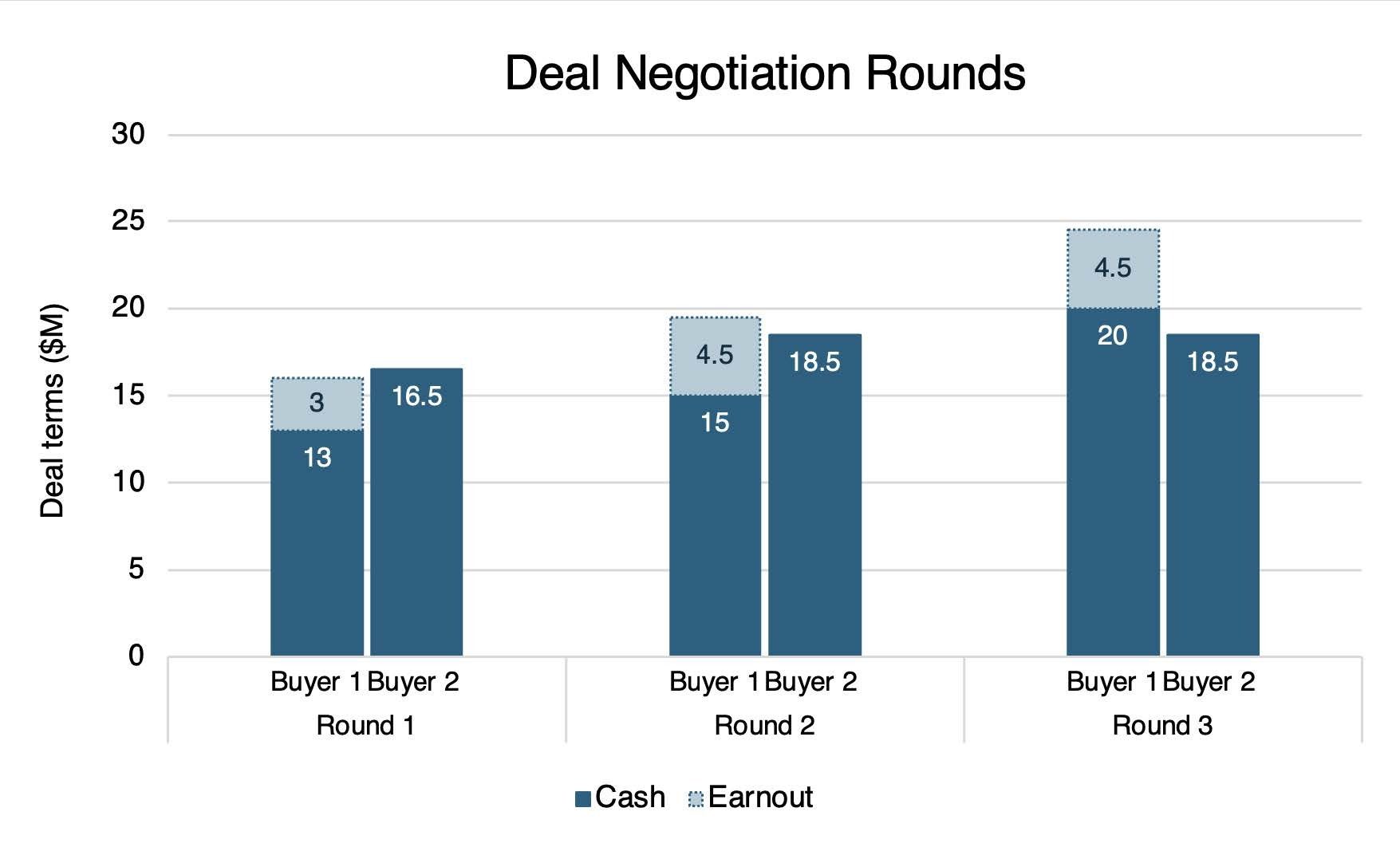

Chart courtesy of The Beringer Group

5. How will the succession plan impact key stakeholders, such as employees, clients, and shareholders?

Considering how your succession plan will affect key stakeholders is essential to creating a smooth process. In one way or another, your employees, clients, and shareholders have all helped the company reach success. Failing to consult them will result in a faulty plan. An effective succession plan incorporates all members of your business and gives each member the opportunity to share their opinion. In turn, creating a cohesive and transparent plan everyone can stand behind.

Now that you understand the basics you are probably asking yourself the most important question…

6. How do I start?

Succession planning is a complex process, which is why it is a good idea to contact a professional and have them guide you through the process. Hiring a professional allows you to make well-informed decisions about the future of your business. If you are looking for an expert to accompany you on your succession planning journey, contact The Beringer Group. The Beringer Group specializes in succession planning and has helped countless companies make the toughest decisions of their lives. Contact us today and start planning your business's future before it’s too late.

Know the game: How to win when selling your business

Selling your business is one of the biggest decisions you’ll make, and it’s worth approaching with care. Many owners are understandably drawn to the first serious offer that comes their way, especially if it seems fair or arrives at the right time. But if you don’t understand the current market conditions or what similar companies are selling for, it’s hard to know whether that proposal reflects your business’s true value.

The best outcomes come from preparation: understanding what drives value in your industry, knowing what buyers are looking for, and having multiple paths forward. A well-planned exit will give you choices, and choices give you peace of mind. The sections that follow outline a few key ideas to help you enter the process with clarity and control.

Know the market

Understanding how businesses like yours are valued is a large part of planning a successful exit. Ask yourself: What are similar companies in my industry selling for? Who are the buyers, and what are they looking for?

Timing matters, too. It may be a good time to sell if valuations are high, there’s active interest in your industry, or strategic buyers are looking for businesses like yours. On the other hand, if the market feels slow or valuations are lower than expected, it might make sense to wait and focus on building the business further. Knowing where you stand in the market puts you in a better position to make confident, well-timed decisions.

An effective succession plan incorporates all members of your business and gives each member the opportunity to share their opinion. In turn, creating a cohesive and transparent plan that everyone can stand behind.

Leverage

Having more than one buyer at the table gives you leverage. Competition over the sale can create what some call “deal heat,” where buyers are more motivated to put out their best offer. This can lead to better terms, such as a higher purchase price, a simpler deal structure, or a faster process. It also creates an opportunity to negotiate offers; comparing what different buyers bring to the table allows you to choose what makes the most sense for you and your business.

On the flip side, relying on just one buyer can make the process more delicate. If that buyer changes their mind, pushes for larger concessions, or delays the timeline, you might find yourself pressured to agree. Leverage is what gives you breathing room. It creates space to negotiate, step back if needed, and move forward on your own terms.

Avoid regret

Before proceeding, it is important to take the time to understand the market or seek input from trusted advisors. If you don’t, you may end up undervaluing your business and accepting terms that don’t quite align with your goals, which could lead to regret in the long run. The good news is that a bit of early preparation can help prevent that. Buyers tend to value businesses with clean, up-to-date financials, a well-balanced customer base, and a clear track record of growth.

It’s also important to consider what you want personally, whether that’s fully retiring, staying involved for a few years, or starting something new. Knowing your goals early on can change the way you approach the deal and make sure you don’t look back wishing you had done things differently.

Selling your business is a big step, and it should reflect the same time, effort, and care that you’ve put into building it. The outcome of the sale is not just the bottom line number, but also about shaping the future you want.

The best results come from planning ahead. When a sale feels rushed, it’s easy to overlook seemingly minor details that can leave value on the table. Having trusted advisors—such as a financial advisor, lawyer, or accountant—can be very helpful. The right support can help keep things organized, connect you with serious buyers, and ease any urgent pressure.

By taking the time to understand your market, build leverage, and plan your next chapter, you can maintain more control and create a better chance at finding the smooth and fair exit that feels right for both you and your business.

ABOUT THE AUTHOR: